Insights

Ensure Import Compliance with Spot-Check Audits of Carrier Billing Statements

Very few words evoke feelings of fear and loathing quite like the word “audit.” But Compliance professionals understand that auditing internal trade compliance processes is a necessary method of maintaining healthy trade controls and avoiding costly penalties.

Performing an audit does not have to be a major undertaking: sometimes a focused spot check can be very revealing. For example, if your company relies on a common carrier such as FedEx Corporation, United Parcel Service, or DHL International to take care of U.S. Customs and Border Protection (“CBP” or “Customs”) import clearances, consider reviewing the monthly billing statement on a regular basis.

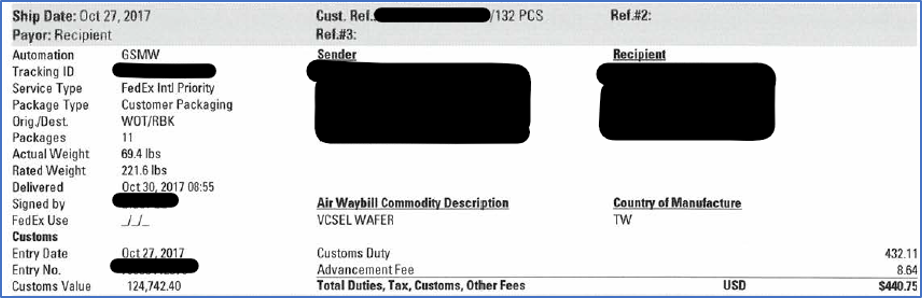

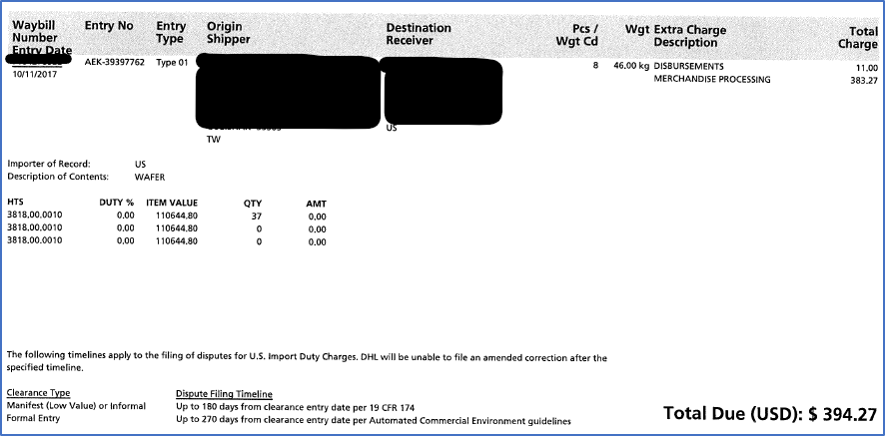

In most cases, common carriers will provide shipment detail for each cleared entry performed on behalf of the company as a part of the billing statement. Shipment details typically include the information provided to the carrier by the foreign-origin shipper, as well as details of the Customs entry, often with a copy of CBP Form 3461 for Entry/Immediate Delivery and CBP Form 7501 Entry Summary.

Here are some examples:

Under the import laws the responsibility for ensuring accuracy of the import information falls squarely on the shoulders of the importer of record. Failure to accurately report import information can result in significant civil fines and even criminal penalties.

For audit purposes, the carrier-shipment details from the billing statements provide a quick and easy way to perform a spot check to determine if your company is meeting the federal requirement for accuracy. Two key points of data worthy of examination are the Harmonized Tariff Schedule (“HTS”) codes and the item value.

Review the HTS codes to determine if the code accurately describes each commodity. The HTS code determines the “dutiable value” or the amount of Customs duty you are required to pay for import of a foreign-origin commodity into the United States. This can be particularly important in the case of items that are returning to the U.S. for repair or replacement as they are generally allowed duty-free entry.

Next, review the declared Customs value. Does the item value represented on the statement accurately represent the transaction value for the merchandise purchased? In a standard arms-length transaction, the value reported should reflect the price paid or payable for the item, excluding any fees associated with bringing the item into the U.S. such as Customs duties, freight charges, insurance, or other service fees.

What do you do if you find an error in the import data? The import regulations require the importer of record to use reasonable care in providing information pertaining to imported goods such that the appropriate duty rate can be assessed. If the information provided is not accurate, the importer of record should coordinate with the carrier to correct the information.

Commercial carriers report import data to CBP via the Automated Commercial Environment (“ACE”) system. If you find an error in your import entry summary, contact your carrier directly to request an updated entry. Ensure that you keep detailed records pertaining to the transaction(s) to be amended, as well as records of your communications with the carrier. Make sure your carrier provides you with a copy of the corrected Customs entry information for your records.

Will correcting an entry trigger a penalty or audit? Possibly, but in most cases, occasional corrections to entries will not result in any type of enforcement action by CBP. Regardless of the possible consequences, importers must adhere to the regulatory obligation to accurately report import data. If your spot checks reveal multiple errors, then a systemic issue may be the root cause and a formal audit may be necessary to determine the extent of the errors. If you discover systemic reporting errors, we highly recommend you seek the advice of experienced legal counsel to determine your next steps and assist in mitigation of potential fines and penalties.

Is there a better way? Yes: you can conduct an in-depth audit of your import filings by creating an import report in the ACE system. Though a review of carrier billing statements can provide a quick spot check with regards to a few data points, an ACE import report will provide all relevant data points for the past several years of entries. Once your company is set up within the ACE system, we recommend regular audits of the import information filed by third parties or the importer of record.

If you need assistance with reviewing your import data or have questions about import regulations or the ACE system, please do not hesitate to contact Torres Law.